What is Behavioural Coaching?

What is Behavioural Coaching and why it is one of the reasons why people need advisers?

This has been described as how a financial adviser helps people achieve their investment objectives by managing their emotions when markets fall and ensuring they stay invested.

This is one of the most significant impacts an adviser can have on an individuals investment returns.

Investing in the stock markets has been described as an emotional rollercoaster. When markets are high people want to invest and they want to withdraw their money when markets fall. THIS IS THE WRONG THING TO DO and is called ‘buying high and selling low’.

Many research papers (www.edvoa.co.uk) have demonstrated the cost of doing this to be a REDUCTION in investment returns of 1.5% to 2.00% per annum and this impact is huge when compounded over time.

Using an adviser will help to reduce fears, to ignore the noise created by anxious investors and media outlets and, crucially, will ensure staying invested.

In other words, using an adviser means keeping calm and achieving future life goals.

This is outlined in a video that can be made available for your clients

Making ‘Evidence Based’ Adviser Decisions

Using Data to analyse the benefits of working with an adviser

At the beginning of the year, I was invited to take part in the PFS roadshows. Over the course of the meetings, people often asked why I decided to set up EDVOA, the suite of online tools that helps advisers have conversations with their clients about the value of advice.

I started working in financial services over 20 years ago. I quickly found that helping financial advisers was a passion of mine and that has remained undimmed by the passage of time.

I’ve been fortunate enough to witness the impact advice can have on clients’ lives. It was my early experiences with clients that taught me the importance of engaging them in understanding more about their investments.

So, I’ve always sought opportunities to provide tools for advisers to educate clients. I’ve done that with the different businesses I’ve worked for but there came a point for me where it became significant enough to be more than a by-product of my job.

One of the catalysts for doing more was reading the Adviser’s Alpha paper published a couple of years ago by Vanguard. It was the trigger for me to carry out further research, reading many other studies that have been published on the topic.

I absorbed all this information, but it became clear to me that their message in these papers, and the facts they were presenting, needed animating in order to help people better understand the value of advice. They needed to be brought to life and personalised to individual circumstances. I wanted to show the effect of advice over time, not just the single annualised figure (around 3% in the Vanguard study).

EDVOA is my outlet for this, and desire to educate clients on the value of advice. EDVOA stands for Education and Demonstration of the Value Of Advice.

With the EDVOA, I have sought to collate the information from four of the published papers and deliver tools that bring the value of advice to life using specific data and compounding the value of advice.

My ultimate aim is to help advisers help clients understand the value of we all know an adviser delivers by showing them the evidence – the data. They can then decide whether the advice they are receiving is worth the fee – making evidence based adviser decisions.

If you’d like to give EDVOA a go and start educating your clients on the value of advice, try EDVOA for free for 14 days.

‘I am not going to pay the ongoing fees’

If a potential new client said this to you would you be able to respond convincingly and decisively?

Adviser Jon Landy of Acumen Financial Partnership had this situation recently present itself and was both prepared and had a demonstrable process to articulate his value in a way that was meaningful for the client.

After a lengthy and detailed analysis the adviser and the potential client decided that they wanted to progress with the advice to transfer a pension. The client was very happy with both the advice and the advice fee charged. He did however baulk at the ongoing fees and simply stated that ‘I do not want to pay them’ as he could not see the benefit.

Unlike many advisers, Jon remained totally calm and promptly logged in to the EDVOA tools he had previously signed up for and demonstrated the AAV tool (Adviser Added Value) which was able to provide a number to the additional value he provided and the benefit this would provide the client.

The AAV tool highlights a number of factors such as behavioural coaching, financial/tax planning, rebalancing and withdrawal strategies that are provided by advisers and uses research from companies such as Vanguard, Morningstar and Envestnet to show the impact of this advice on a client’s investment returns.

The result? The individual said ‘I can really see the value you add’ and became a new client.

Of course, we know there are many other reasons why financial advice is so important such as helping people understand and achieve their future objectives, protecting the family, ensuring a happy retirement and supporting the estate. This is ultimately about providing peace of mind.

The regulator and media are constantly focused on the value of advice as well as prospective new clients. Although the conversations are not happening yet, what if your existing clients said, after all the fantastic advice you have provided, ‘I do not want to pay the ongoing fees’? What would you say? How would you articulate the value? Practicing the response to that client statement is essential, whether you use the EDVOA tools or not.

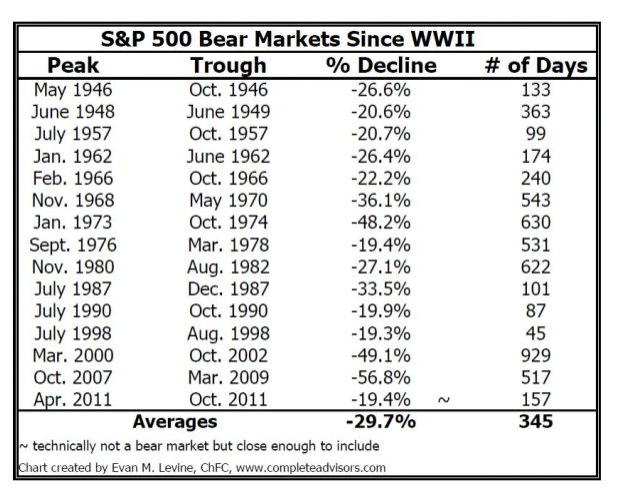

Advisers should definitely NOT be defensive of their fees but should be clear and well versed in justifying them. After all, we all know that fees only come into question when fund values fall and they have not fallen since the Iphone was launched – that means that we may well be out of practice! There have been two c 50% drops in the last 19 years and when the next fall happens, that is when fees will come under scrutiny even more.

Be prepared and be proactive before the questions arise.

As Warren Buffet stated ‘Price is what you pay and value is what you get’ and EDVOA tools could help you demonstrate that value, just like Jon Landy did!

If you would like further information on EDVOA please click here

Are advice fees facing the perfect storm?

Years of working in the financial services industry has only cemented my belief in the value of the advice financial advisers give to their clients. Time and time again, I’ve seen evidence of the difference advice makes to clients and the outcomes they want to achieve in their life. So, as we start to see pressure on adviser fees, the idea of people leaving their adviser, deciding to go it alone, worries me. Research from companies like Vanguard shows that good outcomes don’t result from this decision.

So, it’s up to advisers to clearly explain the value to clients, helping them to understand the effect good advice can have.

This isn’t the first time advisers have had to justify fees. We’ve been here before in various guises – with commission disclosure in the eighties and RDR leading to the emergence ongoing fees. It’s not that ongoing fees aren’t a good thing for the client – the transparency of fee undoubtedly is. But it does mean we have to explain it more, and better. And the need to explain it is exacerbated by other pressures.

Factors placing pressure on fees

Market corrections are playing a role. As you can see from the table below, we’ve seen two market corrections of 50% in the last 18 years.

We have the results of MiFID II, with advice fees front and centre on statements at the same time as potentially frequent updates direct from platforms when there is a 10% fall in the market.

Finally, we’re seeing banks, asset managers and insurance companies re-enter the advice market with competitively priced propositions.

Advisers are and will continue to see more challenge on fees. So it’s important they are able to articulate the value in monetary terms, as well of course, all the intangible benefits – protection of the family, a secure retirement, supporting the estate and of course peace of mind.

EDVOA’s suite of tools put a number on the value of advice. The outputs are designed to complement the conversations you have about the less tangible benefits of advice. Reinforcing the importance when the discussion comes to financial value.

If this has got you thinking, try EDVOA for free for 14 days.

These are just some of the pressures on fees and now, against this backdrop, we need to help clients understand the value of advice.

Compounding the value of advice

We talk about compounding investment returns so why not talk about compounding the value of advice?

Are we having the right conversations?

There is much value in individuals seeking professional financial advice throughout their lifetime. Often there are significant life events that require specific financial advice but it is ensuring that the client stays on track during those events – the ongoing monitoring and adjusting – that can often determine the long term success of an individual’s future.

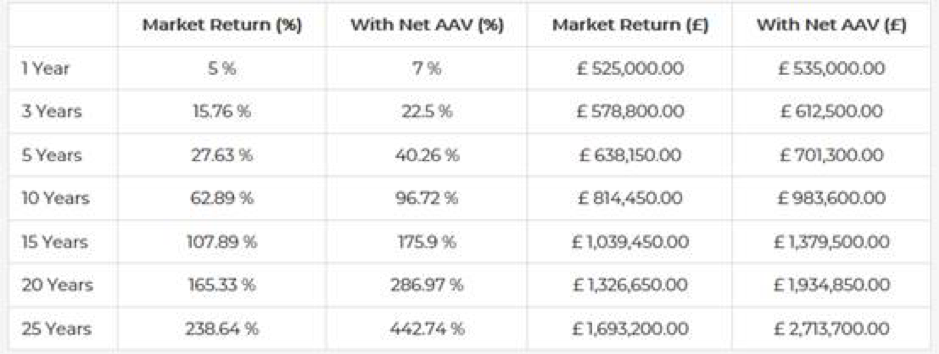

A number of studies undertaken by large investment companies such as Vanguard, Morningstar and Russell Investments have aimed to identify any additional ‘alpha’ for members of the public seeking professional financial advice. These studies had landed on different figures but they all indicated an approximation of around 3% of additional returns above the market return each year. Even if this figure was only 2% what would the difference in return for clients be if the market return averaged 5% per annum.

The table below shows the impact of this potential increased return of an initial £300,000 investment over various time periods.

The impact is significant and to paraphrase Albert Einstein, may be compounding advice could be the next wonder of the world (OK – not quite but it’s good to aim high).

EDVOA is suite of online tools to help complement the conversations you are having withyour clients, demonstrating the value of advice.

Alan Moran explains how EDVOA will help show the difference

Treating my clients with care and consideration is part of the value I can offer them.

Alan Moran of Interface Financial Planning discovered the EDVOA suite of tools at a recent PFS Regional Conference. Alan has kindly agreed to explain how he might use EDVOA in his business.

Making a difference to lives

Making a difference to lives I’m in business for one reason; my advice makes a difference to peoples’ lives – it’s my way of helping them. I wouldn’t be running a financial advice business if I couldn’t do that. We believe in looking after people and treating them as individuals with different starting points, problems, opportunities and ambitions. To me, they aren’t a segment or an asset value; they’re varying bundles of worries and joys that I need to make a difference to and treat with care and consideration.

Where will EDVOA fit in to my business?

The care we take of our clients and their money is where we deliver our value. My customers always appreciate the personal care and consideration I put into managing their financial affairs. It’s the way I run my business and I wouldn’t want it any other way.

There are a couple of drivers for considering how I can incorporate the EDVOA tools into my business.

Being an ex-teacher, I like helping my clients understand their financial situation and options. Finding ways to explain and ensure they have the right level of information. I use a number of tools to help bring the circumstances to life. Alongside my trusty flip chart and pen, EDVOA could be a useful addition to client meetings – helping to demonstrate the difference in return of financial planning with my advice.

In addition to helping to demonstrate the value of my advice, EDVOA proves useful as evidence for clients and the regulator.

As I start to integrate EDVOA into my existing processes, I’m looking forward to the conversations the tools will help me to have with my clients – further shedding a light on their circumstances and the actions we are taking together.

Financial advice: a balancing act

Balancing the intangible with the tangible; is that the true value of advice?

One of the challenges facing the financial advice profession is how to demonstrate the true value of the work you do for clients.

- How do you demonstrate the less tangible benefits – how do you talk about value when it relates to peace of mind and reassurance?

- The real value is delivered over a longer period of time – how do you help people understand this?

As the founder of EDVOA, I am acutely aware of these challenges and in developing the tools, found myself working through the different value aspects in receiving financial advice. I found the process a really useful way of reminding myself why financial advice is so important and the difference it can make to lives. We all need a reminder from time to time, so I decided to share my thoughts.

The benefits of financial advice

Know where you’re going

As Roland Byrd said

“it is hard to reach your destination when you do not know where you are going. Having a target makes all the difference!”

As financial advisers, we get a clear picture of the client’s future goals and aspirations – we fact find. We combine this with our understanding of your current situation to give us a kicking off point.

It sounds easy to set out your future plans but it isn’t. Good advisers can help bring clarity to this area – helping clients to identify, explain, and articulate future life plans and crucially help construct a financial plan to get them there.

Support through the ages

The advice you get from financial advisers is given over a long period, and will support across a range of life stages, but always with the long term in mind.

Even when the client isn’t thinking about their financial circumstances, their financial adviser is advising on the (sometimes small) decisions that need to be made that will have a positive impact in the long term.

Knowing someone is there, keeping an eye on the long term financial wellbeing, is reassuring for clients. And of course, there are the questions and decisions that come up in the intervening years that you advise and guide on – helping clients to balance short term needs with long term ambitions. This is where advice makes the difference.

Retirement

Retirement is one of the most complex fields of financial advice. More so since Pensions Freedom have resulted in clients facing an array of options and decisions on income, levels of income, transfers, company pension schemes, annuities, pension drawdown, tax implications…the list is long, and the decisions confusing with long term consequences. Discussing these options with an adviser is essential.

Death

One of the most important benefits of advice is for your clients’ loved ones. An adviser who understands the clients’ financial affairs, can be invaluable in helping grieving relatives navigate this area.

I have personal experience of this. Following the death of my own father, I met with my financial adviser in my father’s home. They’d been working together for over 20 years. My father was very organised and all his financial affairs were in one place. Even with this level of preparation by my father, there was still about 3 inches of paperwork. Even with my experience in the sector, I eyed it with dread – not knowing where to start. The adviser looked at my brother and me and asked ‘do you want me to take care of that’? I felt a huge sense of relief. He gave both practical and emotional support through the probate process, allowing us to focus on our own grief. Looking back, I realise how valuable his help was at that time.

It’s not always about the numbers

Those were just a few examples of the value financial advisers deliver to clients. They are hard to place a monetary value on – I found exploring them a really valuable process when developing the EDVOA suite of tools. Of course, our tools aim to put a number on the value of advice. We do that by demonstrating the difference in investment growth over a period of time. I believe it’s important to help clients understand this number – but only ever to complement the less tangible benefits. When explaining the value of financial advice to clients, I am a strong believer that the most persuasive argument is a combination of both the intangible benefits and financial value.

The Calculations Behind The Tools

But what about the numbers?

The assumptions that power the EDVOA suite of tools are based on extensive research and analysis carried out by a number of organisations. This analysis has sought to place a value on the difference advice has made to investment returns.

We’ve used the following sources to inform our own calculations:

Evestnet Capital Sigma: The Return on Advice

Morningstar Alpha, Beta and Now Gamma

Russell Investments: Why Advisors have never been so Valuable

Russell Investments: Powering Advisor Success

The Kitces Report Evaluating Financial Planning Strategies And Quantifying Their Economic Impact

Dalbar Quantitative Analysis of Investor Behaviour (QAIB)

Although these studies make it clear that that there are a range of factors which can be used to calculate the value, it’s important to recognise that there are many aspects which you can’t put a number on – the peace of mind and reassurance your advice gives clients when planning for their future.

The result of studies explore and place emphasis on a number of contributing factors to the value of the advice delivered to clients.

Vanguard’s study defines the adviser’s Alpha as “the difference between the return that investors might achieve with an adviser and the return that they might have achieved on their own”.

Influencing advice value

From the research, the contributors to the value of advice include:

- Tax planning and mitigation– analysisand actions taken that ensure the correct solutions from a tax perspective i.e. using the most the tax efficient strategies and products.

- Behavioural coaching– when an adviser can bring a dispassionate, impartial perspective to decisions in order to ensure continued successful investment planning.

- Asset allocation– the process of deciding how to allocate investment capital across various asset classes.

- Rebalancing– the systematic and periodic realignment of the portfolio to its target blend.

- Withdrawal strategies– the removal of funds from the best possible account for strategic or tax reasons.

- Investment selection– the cost-effective implementation of your portfolio.

To power our calculations, we have allocated a percentage value to each contributing factor. This value is the lowest value attributed to the contributing factor in the research papers. Advisers can amend our initial allocation to suit the service they offer. They can then input their own fees and compound the returns over time to demonstrate the effect. These are displayed in both tabular and graphical formats and can be exported as a pdf.

What happens next is that the tools demonstrate the benefits of using an adviser over the long term.

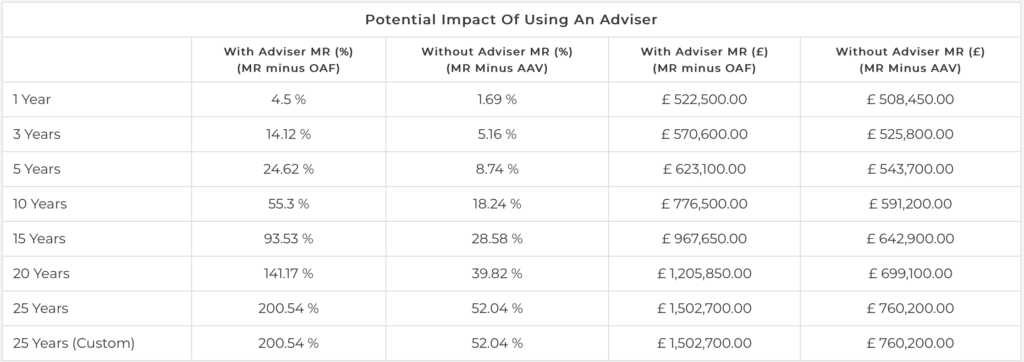

The tool works by using the Market Return (MR) figures, the Annual Adviser Added Value (AAV) Figure and the Ongoing Adviser Fee (OAF).

The With Adviser figures are calculated by: Market Return (MR) minus the Ongoing Adviser Fee (OAF)

The Without Adviser figures are calculated by: Market Return minus the Adviser Added Value (AAV)

These results are then compounded over time.

N.B. The Market Return Assumptions are really important. The default for the tool is 5% per annum. These boxes are entirely editable so it is important that you are comfortable with these numbers.

Case Study

£500,000 invested, assume the market returns on your portfolio are 5%. the Adviser charges 0.5% per annum and the the AAV is 3.31% as shown in the research.

As you can see the benefits of working with an adviser can be significant, and this is especially evident over a long period of time.