But what about the numbers?

The assumptions that power the EDVOA suite of tools are based on extensive research and analysis carried out by a number of organisations. This analysis has sought to place a value on the difference advice has made to investment returns.

We’ve used the following sources to inform our own calculations:

Evestnet Capital Sigma: The Return on Advice

Morningstar Alpha, Beta and Now Gamma

Russell Investments: Why Advisors have never been so Valuable

Russell Investments: Powering Advisor Success

The Kitces Report Evaluating Financial Planning Strategies And Quantifying Their Economic Impact

Dalbar Quantitative Analysis of Investor Behaviour (QAIB)

Although these studies make it clear that that there are a range of factors which can be used to calculate the value, it’s important to recognise that there are many aspects which you can’t put a number on – the peace of mind and reassurance your advice gives clients when planning for their future.

The result of studies explore and place emphasis on a number of contributing factors to the value of the advice delivered to clients.

Vanguard’s study defines the adviser’s Alpha as “the difference between the return that investors might achieve with an adviser and the return that they might have achieved on their own”.

Influencing advice value

From the research, the contributors to the value of advice include:

- Tax planning and mitigation– analysisand actions taken that ensure the correct solutions from a tax perspective i.e. using the most the tax efficient strategies and products.

- Behavioural coaching– when an adviser can bring a dispassionate, impartial perspective to decisions in order to ensure continued successful investment planning.

- Asset allocation– the process of deciding how to allocate investment capital across various asset classes.

- Rebalancing– the systematic and periodic realignment of the portfolio to its target blend.

- Withdrawal strategies– the removal of funds from the best possible account for strategic or tax reasons.

- Investment selection– the cost-effective implementation of your portfolio.

To power our calculations, we have allocated a percentage value to each contributing factor. This value is the lowest value attributed to the contributing factor in the research papers. Advisers can amend our initial allocation to suit the service they offer. They can then input their own fees and compound the returns over time to demonstrate the effect. These are displayed in both tabular and graphical formats and can be exported as a pdf.

What happens next is that the tools demonstrate the benefits of using an adviser over the long term.

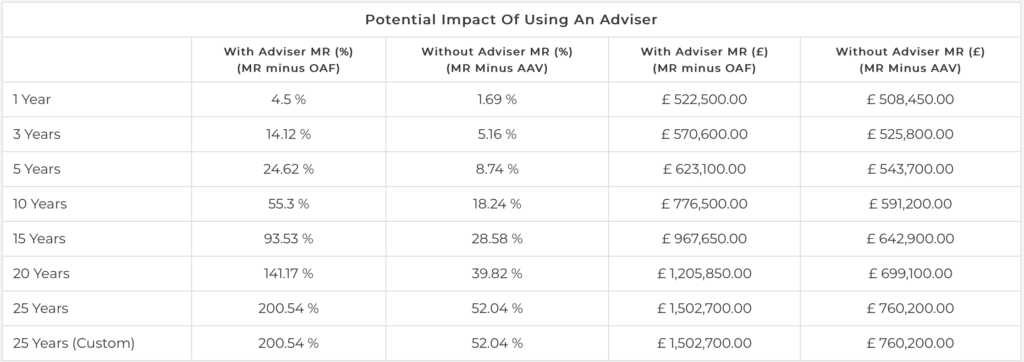

The tool works by using the Market Return (MR) figures, the Annual Adviser Added Value (AAV) Figure and the Ongoing Adviser Fee (OAF).

The With Adviser figures are calculated by: Market Return (MR) minus the Ongoing Adviser Fee (OAF)

The Without Adviser figures are calculated by: Market Return minus the Adviser Added Value (AAV)

These results are then compounded over time.

N.B. The Market Return Assumptions are really important. The default for the tool is 5% per annum. These boxes are entirely editable so it is important that you are comfortable with these numbers.

Case Study

£500,000 invested, assume the market returns on your portfolio are 5%. the Adviser charges 0.5% per annum and the the AAV is 3.31% as shown in the research.

As you can see the benefits of working with an adviser can be significant, and this is especially evident over a long period of time.